Hopefully this guide has helped answer your main questions about filing personal income taxes in Malaysia for YA 2018. Tax residents can do so on the ezHASiL portal by logging in or registering for the first time.

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

For more in-depth information about all things income tax.

. Here is a list of Tips on Income tax planning for Salaried employees. More On Malaysia Income Tax 2019. An obligation of submitting a separate tax declaration by 30 April of the following tax year will also apply.

Learn and enjoy the tax benefits in India 2018. How To File Your Taxes For The First Time. More On Malaysia Income Tax 2020 YA 2019 Hopefully this guide has helped answer your main questions about filing personal income taxes in Malaysia for YA 2019.

Vietnams Law on Personal Income Tax recognizes ten different categories of income with a host of different deductions tax rates and exceptions applying to each of them. Here is a list of Tips on Income tax planning for Salaried employees. A tax resident is defined as someone residing in Vietnam for 183 days or more in either the calendar year or a period of 12 consecutive months from the date of arrival.

If youve received your Income Tax Return EA Form you may start filing your taxes now up until the deadline on April 30 2021. There are no other local state or provincial. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia.

No other taxes are imposed on income from petroleum operations. This is because the correct amount. Learn and enjoy the tax benefits in India 2018.

They all refer to the tax tables whether in whole or as specific sectionscategories of the tax tables therein. True They are exempt from income tax. Personal Income Tax Rate in Bangladesh averaged 2694 percent from 2004 until 2021 reaching an all time high of 30 percent in 2014 and a record low of 25 percent in 2005.

B Multiple Choices Theory 2 would result in multiple 12. This page provides - Bangladesh Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. In the section we publish all 2022 tax rates and thresholds used within the 2022 Malaysia Salary Calculator.

As a result most employees will not be required to lodge Form S returns. The Personal Income Tax Rate in Bangladesh stands at 25 percent. Malaysia Residents Income Tax Tables in 2021.

An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. Malaysia Tax Tables may also be referred to as Malaysia Tax Slabs Malaysia personal allowances and tax thresholds or Malaysia business tax rates. If you have any questions about the whole process dont hesitate to ask us in the comments and well do our best to help you out.

B answers hence inconsistent with 13. Poverty rate of rural and urban areas in Malaysia 2007-2019. For more in-depth information about all things income tax-related check out our other articles below.

PAYE became a Final Withholding Tax on 1st January 2013. Incidence rate of absolute poverty in Italy 2010-2020 by age group. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Final in the sense that once an employer deducts PAYE from the gross salarywage of a particular employee it represents the final tax liability on that income. Most taxpayers pay a maximum 15 rate but a 20 tax rate applies if your taxable income exceeds the thresholds set for the 37 ordinary tax rate. Exceptions also apply for art collectibles and.

As of 1 January 2019 individuals who derive in a tax year income exceeding PLN 1 million are required to pay solidarity tax at the rate of 4 on the excess of this amount. Its tax season again for Malaysians earning over RM34000 for the Year of Assessment YA 2020. Final tax capital gains tax or regular income tax Multiple Choices Theory 1 6.

Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Gstr Due Dates List March 2019 Accounting Basics Important Dates Due Date

Cukai Pendapatan How To File Income Tax In Malaysia

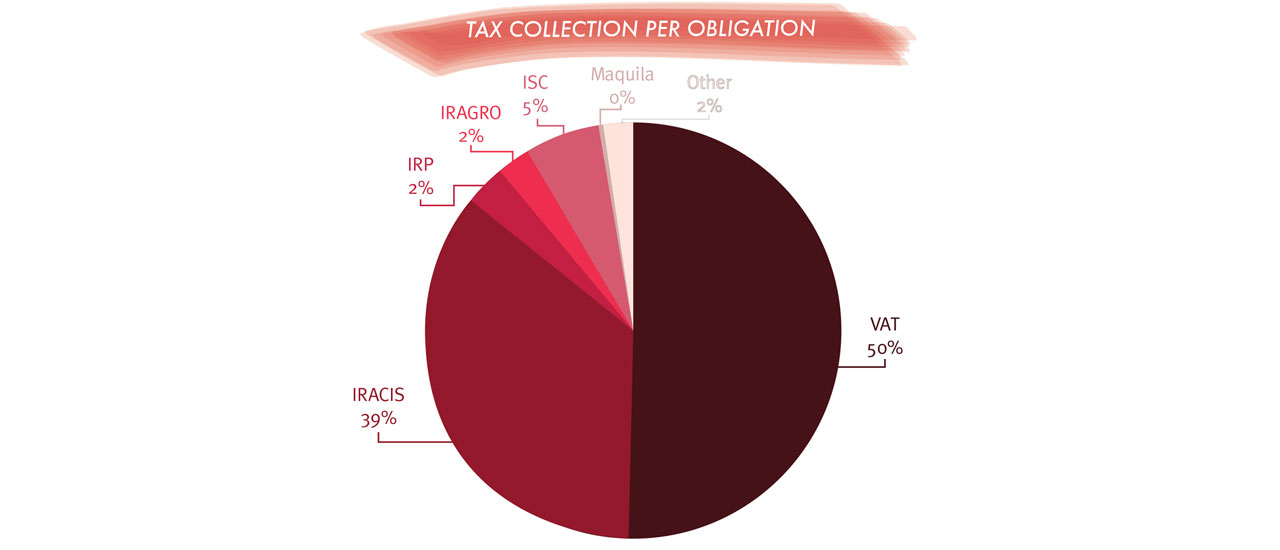

Modifications To The Tax System In Paraguay Ecovis International

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Malaysian Bonus Tax Calculations Mypf My

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

What Bloggers Influencers And Freelancers Need To Know About Taxes In Malaysia Blogjunkie Net

Tax Identification Numbers In Laos Compliance By June 2021

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Everything You Need To Know About Running Payroll In Malaysia

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt